TVPX 1031Depreciation Solution 5.5

TVPX 1031Depreciation Solution 5.5

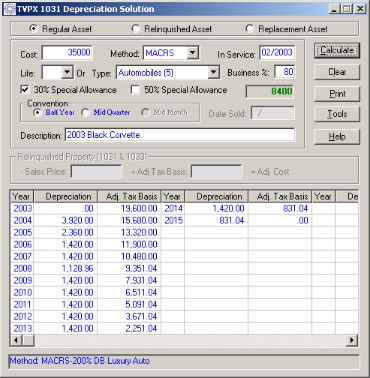

TVPX 1031 Depreciation Solution is an extremely efficient way to calculate federal and book depreciation. All depreciation and amortization methods required for federal tax reporting are included in an easy to use calculator format.

Last update

2 Mar. 2011

Licence

Free to try |

$35.00

OS Support

Windows Me

Downloads

Total: 333 | Last week: 1

Ranking

#797 in

Accounting & Billing Software

Publisher

Microtechware

Screenshots of TVPX 1031Depreciation Solution

TVPX 1031Depreciation Solution Publisher's Description

TVPX 1031 Depreciation Solution is an extremely efficient way to calculate federal and book depreciation. All depreciation and amortization methods required for federal tax reporting are included in an easy to use calculator format. By filling in a few fields, the user can quickly produce a depreciation schedule for a fixed asset. Schedules can be printed or exported to Excel.

TVPX 1003 Depreciation Features

Calculate the adjusted tax basis of replacement property purchased as part of a Like-Kind Exchange under IRS Section 1031.

This is an ideal application for a CPA, or anyone doing taxes, justifying capital purchases, or manually booking depreciation.

A formal depreciation schedule can be printed for an asset.

Current tax rules for depreciation are built in, to guide you through the process of adding assets to meet federal requirements.

Extensive on-line help details methods and tax requirements.

Automobile and 179 limits can be input to stay current with changing tax regulations.

Calculates Luxury Automobile Depreciation.

TVPX 1003 Depreciation Features

Calculate the adjusted tax basis of replacement property purchased as part of a Like-Kind Exchange under IRS Section 1031.

This is an ideal application for a CPA, or anyone doing taxes, justifying capital purchases, or manually booking depreciation.

A formal depreciation schedule can be printed for an asset.

Current tax rules for depreciation are built in, to guide you through the process of adding assets to meet federal requirements.

Extensive on-line help details methods and tax requirements.

Automobile and 179 limits can be input to stay current with changing tax regulations.

Calculates Luxury Automobile Depreciation.

What's New in Version 5.5 of TVPX 1031Depreciation Solution

Export schedules to Excel.

Look for Similar Items by Category

Feedback

- If you need help or have a question, contact us

- Would you like to update this product info?

- Is there any feedback you would like to provide? Click here

Beta and Old versions

Popular Downloads

-

KaraFun Karaoke Player

2.6.2.0

KaraFun Karaoke Player

2.6.2.0

-

Kundli

4.5

Kundli

4.5

-

Macromedia Flash 8

8.0

Macromedia Flash 8

8.0

-

My Talking Tom

1.0

My Talking Tom

1.0

- FastSum 1.9

-

FastSum Standard Edition

1.6

FastSum Standard Edition

1.6

-

Cool Edit Pro

2.1.3097.0

Cool Edit Pro

2.1.3097.0

-

Cheat Engine

6.8.1

Cheat Engine

6.8.1

-

Hill Climb Racing

1.0

Hill Climb Racing

1.0

-

Tom VPN

2.2.8

Tom VPN

2.2.8

-

Windows XP Service Pack 3

Build...

Windows XP Service Pack 3

Build...

-

C-Free

5.0

C-Free

5.0

-

Netcut

2.1.4

Netcut

2.1.4

-

Vidnoz AI

1.0.0

Vidnoz AI

1.0.0

-

FormatFactory

4.3

FormatFactory

4.3

-

Facebook Messenger

440.9.118.0

Facebook Messenger

440.9.118.0

-

Minecraft

1.10.2

Minecraft

1.10.2

-

Vector on PC

1.0

Vector on PC

1.0

-

Horizon

2.9.0.0

Horizon

2.9.0.0

-

Auto-Tune Evo VST

6.0.9.2

Auto-Tune Evo VST

6.0.9.2